Hyundai Motor India’s shares declined by 6% at their first trading on Tuesday, following a weak reaction to the pricing of the largest IPO in India.

The stock listed at 1,934 rupees ($23) on India’s National Stock Exchange, below its offer price of 1,960 rupees ($23.31), and traded down 4% at 1,882.10 rupees ($22.39) by 0548 GMT (1:Indian state-run steel maker Tata Steel Ltd rose to 1.53 trillion rupees ($18.2 billion) as of 48 a.m. ET.

Hyundai, India’s second largest carmaker with 15% market share, was aiming at achieving $19bn through the IPO.

While its record $3.3 billion IPO was oversubscribed more than two-fold last week led by institutional investors, pricing concerns prevented retail investors from participating as they feared that they would not be able to make profits on the listing.

Stocks of Indian rivals have also declined in the last few weeks as automobiles sales have come down after two consecutive years of growth with consumers waiting for inflation rate to come down.

“Hyundai’s issue has been stiffed priced and that seems to be pulling down on its listing as well,” said Arun Kejriwal, founder of Kejriwal Research.

“Besides, the volumes seen so far are driven only by institutional investors and is rather poor for an IPO of Hyundai’s size.”

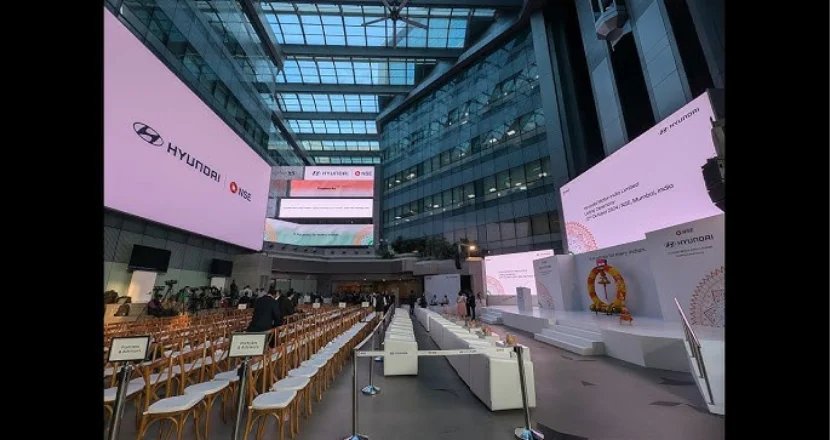

Tuesday’s listing in Mumbai marks the first initial public offering outside the South Korean carmaker’s home market and comes as India’s equity markets have surged.

Hyundai Motor targets to invest in research and new products to compete with domestic rivals such as Tata Motors and Mahindra & Mahindra and utilise the sale of 17.5% stake of India unit for its funding.

Hyundai Motor will be a key driver of Hyundai Motor India’s future growth through the cooperation in research and development and design as well as manufacturing, Hyundai Motor’s chief executive officer Jaehoon Chang said in a listing ceremony in Mumbai.

Seven of the ten biggest Indian IPOs this year including Hyundai India suffered listing day losses of between 5 percent and 27 percent, as per data from Dealogic.

Hyundai Motor’s market capitalisation is much smaller than $45bn of Maruti Suzuki India, India’s largest car market leader, but some analysts have recently frown at the shrinking gap between Hyundai’s and Maruti Suzuki’s P/E ratios.

The issue had placed Hyundai’s worth at 26 times fiscal 2024 earnings – close to what Maruti commanded at 29 times.

Nonetheless, some of the large brokerage firms believe that the stock has long-term fundamentals.

Nomura initiated the coverage of Hyundai Motor with an “overweight” and a price of 2,472 rupees ($29.40). The brokerage stated it found Hyundai’s SUV mix attractive with 67% mix of sales in Q2 of CY 2024.

Likewise, Macquarie started coverage with ‘outperformer’ and a target of 2235 rupees ($26.58), asserting that, Hyundai has the premium P/E for an SUV-focused carmaker.

‘We will build on our understanding of customers’ needs in order to successfully broaden the range of cars in the passenger category,’ Hyundai India chief operating officer Tarun Garg said during the listing.

Maruti and Tata Motors fell by 1% and that was in concordance to the Nifty Auto index.